Friday's Sermon: Jan 29/21

In today's weekly newsletter, I try to make sense of the great Battle of GameStop.

If you had “bunch of Redditors buy up GameStop stocks to fight off a short attempt by a Wall St. hedge fund” on your prediction list for 2021, congratulations. You may be psychic. As for the rest of us, this current situation is only the latest in a wild rollercoaster of events that began with COVID-19 and national lockdowns in early 2020.

For those of you who are unaware, some hedge funds decided in late 2020 to short GameStop stock in order to make a lot of money. Shorting is a financial method in which someone bets against a company’s stocks. Suppose, for example, that company X currently has stock at $20/share. For whatever reason, you believe this company is on the verge of collapse. You go to a stockbroker and ask to borrow some shares, and end up with five shares worth a total of $100. You immediately sell those shares, gambling on the assumption that the stock will collapse soon. Next week, the stock collapses and company X is now valued at $2/share. You buy back five shares at a total of $10 and return them to the broker you borrowed the shares from. You also pocket $90 in the difference.

Shorting carries with it great risk. Suppose that company X does not collapse. Somehow, the company discovers faster than light travel, and the company value multiplies. Stocks are now worth $300/share. You still owe the broker the five shares you borrowed, and the deadline is up. Therefore, you have to go back into the marketplace and buy five shares for a total of $1500, resulting in a $1400 loss for you.

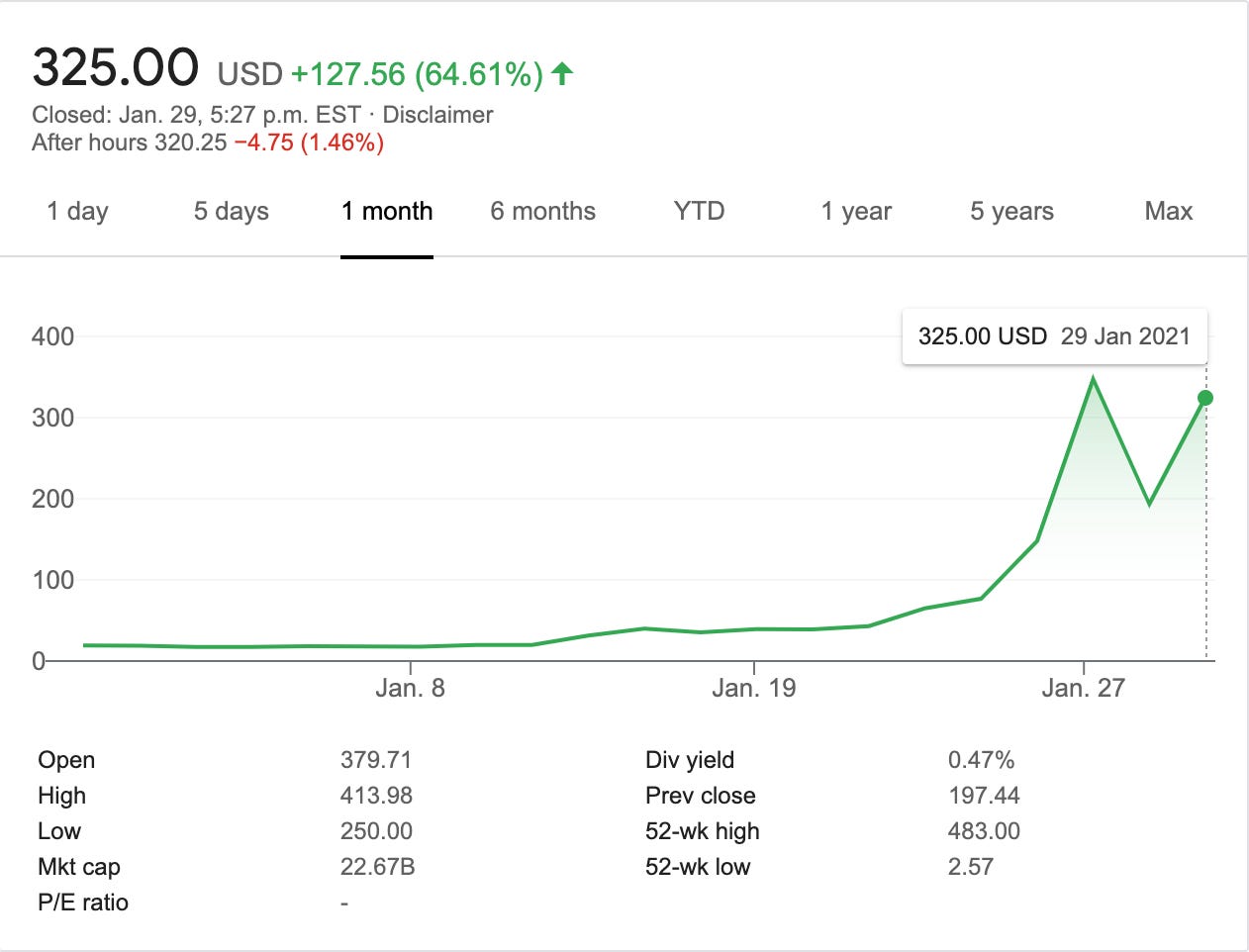

The subreddit r/wallstreetbets had noticed the attempts by hedge funds to short the GameStop stock. Consequently, redditors encouraged each other to buy up GameStop shares en masse. The idea here is that if redditors buy up the stock and hoard it, the price will skyrocket and hedge funds will be forced to close their position, which is to say the funds will have to buy the shares at a loss to return the shares to the brokers they borrowed them from. This is a rather strong oversimplification but ultimately this process has led GameStop shares to skyrocket from $20/share at the beginning of 2021 to closing at $347/share as of last night January 27.

There are several lessons to be learned from this developing situation. Firstly, the stock market has no relation to the real health of an economy nor does it reflect any real use value. GameStop has not invented some groundbreaking new gaming technology. As the analysts chiming in on CNBC and Fox Business keep reminding us, the fundamentals at GameStop remain the same. The stock market relies largely on perceptions of value. In other words, shares increase in value when buyers exhibit confidence in them and vice versa. Therefore, it is entirely unreliable to use the stock market as a reflection of an economy.

Secondly, shareholding is proof of alternative ownership models to the capitalist-worker relationship. While stocks today completely alienate the owners of a company, the stockholders, from the company’s work and labour, it also acts as an example of collective ownership that can translate to worker ownership. Imagine if workers at a given workplace collectively owned their company much in the same way that shareholders currently do. Instead of a board of directors acting as representatives of those shareholders, workers can democratically elect a board and make major decisions communally. All it takes is a cursory look at shareholding to see that this can work if only the political will is there.

Finally, as Marx says in the Communist Manifesto, the “executive of the modern state is but a committee for managing the common affairs of the whole bourgeoisie.” As GameStop share value continues to rise, the political class in the United States has raised the alarm about market volatility and is now acting quickly to prevent a similar situation from happening. Why? Well, Melvin Capital, one of the hedge funds that bet on GameStop to fail, has had to close their shorting position with a $2.4 billion loss. They also needed two other hedge funds to inject billions of dollars into Melvin to keep them solvent. The hedge fund managers and owners of capital are mortified that a bunch of day traders on an online forum brought a big hedge fund to its knees. That cannot happen again. The free market is only free to the capitalist class. That freedom cannot and will not be extended to the rest of us.

Does that mean that we should ignore the great Battle of GameStop circa 2021? I won’t. Day trading stocks via r/wallstreetbets advice may not bring about The Revolution™️, but it sure is hilarious. Personally, I will continue to root for the reddit freaks, and the more I watch Wall St. suits have collective aneurysms live on CNBC, the more the reddit traders win me over. Keep it up nerds.